ATO Tax Residency Rules—Understanding Your Tax Obligations

Posted 4 Aug '23

Posted 4 Aug '23

Understanding your tax residency status is of utmost importance when it comes to meeting your Australian tax obligations. However, this aspect of taxation is far from black-and-white, and that’s where it’s so important to know the ins and outs if you are considering a change to your residency status.

The concept of tax residency is of paramount importance in the Australian tax system. It determines the tax rates applicable to individuals, differentiating between residents and non-residents for tax purposes. Also, tax residency status can significantly affect various tax benefits and concessions, including the Capital Gains Tax (CGT) discount.

The ATO employs a comprehensive approach and a number of tests to determine tax residency, which considers a multitude of facts. It is crucial for individuals to be diligent about understanding their tax residency status, as the ATO does not automatically classify individuals based on nationality or permanent residency status.

Whether you are a non-resident or a resident earning any income in Australia and required to lodge a tax return, the determination of your tax residency is a pivotal step. Let’s dive into each residency test, shed some light on what it means to be a resident for tax purposes in Australia, and solidify the tax law applications for residents and non-residents.

The Resides Test is a primary criterion used to differentiate individuals residing in Australia permanently or for a considerable duration from those merely visiting, temporarily working, or studying. If you temporarily leave Australia without establishing a more permanent home in another country, you are likely to be considered an Australian resident for tax purposes.

Similarly, if you migrate to Australia with the intention of living permanently, you would also pass the resides test. Various determinants influence the resides test, such as your physical presence, purpose for living in the country, and living arrangements, among other factors.

Notably, an individual’s nationality or permanent residency status alone does not confer tax residency. For example, an individual born and raised in Australia may relocate to another country permanently, becoming a non-resident for tax purposes.

If you do not pass the resides test, there are three alternative tests you can meet to qualify as a resident for tax purposes:

It’s important to note that the Superannuation Test does not apply if you are a member of the Public Sector Superannuation Accumulation Plan (PSSAP). If you qualify as an Australian resident under this test, your spouse and any children under 16 years old are also considered Australian residents for income tax purposes.

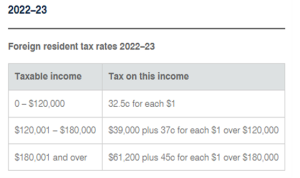

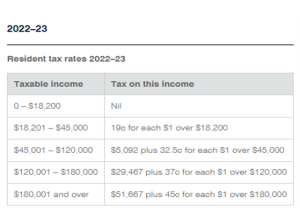

As you probably know, the ATO taxes individuals based on which income bracket they fall under. To help you gain a clear view of how much you can expect to be taxed, find the 2022-2023 income tax rates for residents and tax rates for non-residents of Australia below:

Foreign residents who acquired assets after 8 May 2012 are not entitled to the 50% capital gains tax (CGT) discount if they choose to sell that property. This means that non-residents may face higher tax liabilities on capital gains when selling assets in Australia.

Tax residency can undoubtedly be a grey area with multiple factors at play, making professional assistance valuable in ensuring compliance with ATO tax residency rules.

Here at Empire Accountants, we are here to help you navigate the complexities of tax residency and ensure you meet your tax obligations accurately. Contact Us today for expert guidance from the best accountants in Brisbane, and personalised solutions to secure your financial future with confidence.

When you plan with intention - and pair it with accountability - you’re not just hoping things will work out. You’re building a business that will.

.jpg)

Let’s face it; bookkeeping isn’t the most exciting part of running a business. However, it’s one of the most important! Keeping your financial records in check not only helps you stay on top of your business but moreover ensures you're meeting Australian Taxation Office (ATO) requirements without stress or penalties.