COVID-19 Update: Working from home tax deductions

Posted 23 Apr '20

Posted 23 Apr '20

Updated: 15 June 2021

Due to COVID-19, many employees are still able to do their job working from home. The ATO has recognised that employees may incur additional expenses and as such have introduced a new method of claiming deductions at tax time.

If you have been working from home at any time during the period 1 July 2020 – 30 June 2021 will be able to easily claim 80 cents per hour of your running expenses. The ATO has labelled this as the Shortcut Method.

With this new method, there are now 3 ways to calculate your running expenses if working from home:

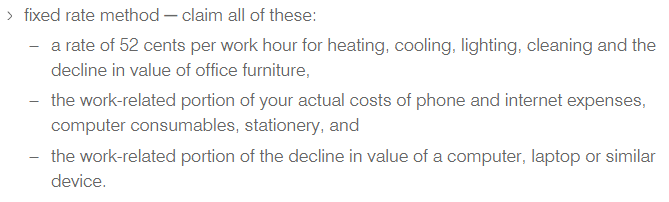

The Fix Rate Method

Actual Cost Method

![]()

The Shortcut Method

![]()

The Shortcut Method that has been introduced is the simplest way to calculate and claim a deduction for the period an employee has been working at home due to COVID-19. It applies when the employee is:

– Working at home to fulfil their employment duties and not just minimal tasks such as occasionally checking emails or taking calls.

– Incurring deductible running expenses due to working from home.

Using this method, you do not have to portion out a percentage of usage for certain expenses, such as a dedicated work area, electricity, phone etc (which in turn would usually require records for the percentage of usage for each expense).

Instead, claiming a working from home deduction using this method, covers all the following:

– Electricity, lighting, cooling/heating

– Decline in value and repairs of capital items (furniture etc)

– Cleaning costs

– Phone and internet costs

– Computer consumables and stationery

– Decline in value of computer or laptop

You don’t have to incur all the expenses listed above, but you must have incurred some within these categories.

Unlike the Fix Rate or Actual Cost Method, the only records you must keep to claim using the Shortcut Method is the number of hours you have worked from home due to COVID-19 (eg, time sheet, roster etc) during the time period 1 July 2020 – 30 June 2021.

This method would be best to use if you’ve been working at home due to COVID-19 and haven’t had to buy any extra equipment or materials, only use your personal phone for minimal work correspondence and aren’t buying excessive consumables/products directly related to fulfilling your employment.

If you are an employee that usually works from home throughout the year, or have had to buy a lot of equipment yourself (such as computers, desks, consumables) that you aren’t being reimbursed for, it may be better for your to use the Fix Rate Method to ensure you are claiming the deductions you are entitled too.

However, keep in mind if you choose the Fix Rate Method or Actual Cost Method you will have greater substantiation requirements to keep logbooks, diaries, receipt and evidence to support the work-related portions that you are claiming.

The 3 general rules that apply to all methods are:

1. You must have spent the money yourself and not be reimbursed by your employer

2. The claim must be directly related to earning income

3. You must have a record to substantiate your claim

If you’d like assistance with determining which method is right for you at the end of this financial year, please get in touch with our office.

More information about tax deductions for working at home can be found on the ATO website here and here.

When you plan with intention - and pair it with accountability - you’re not just hoping things will work out. You’re building a business that will.

.jpg)

Let’s face it; bookkeeping isn’t the most exciting part of running a business. However, it’s one of the most important! Keeping your financial records in check not only helps you stay on top of your business but moreover ensures you're meeting Australian Taxation Office (ATO) requirements without stress or penalties.