Important announcement regarding director identification numbers.

Posted 1 Nov '21

Posted 1 Nov '21

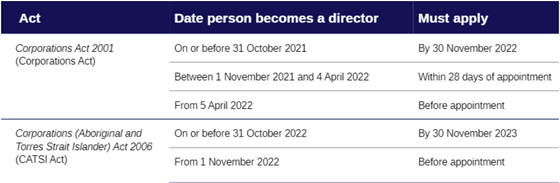

New rules have been introduced with effect from 1 November 2021 with regards to verifying your identity to act as a director in Australia. You need a director identification number (director ID) if you’re a director of a company, registered Australian body, registered foreign company or Aboriginal and Torres Strait Islander corporation.

The Director Identification Number (Director ID) is a unique identifier that will help prevent the use of false or fraudulent director identities with the new registry services of the Australian Business Registry Services (ABRS). These numbers are to be kept confidential and should be treated with the same privacy restrictions as tax file numbers.

Directors must apply for their director ID themselves because they need to verify their identity.

The fastest way to do this is online using the myGovID app.

You will need a myGovID with a Standard or Strong identity strength to apply for your director ID online. If you live outside Australia and can’t get a myGovID with a Standard or Strong identity strength, you will need to apply with a paper form and provide certified copies of your identity documents. If you live in Australia and:

Please note myGovID is different from myGov

You will need to have some information the ATO knows about you when you apply for your director ID:

Examples of the documents you can use to verify your identity include:

Once you have a myGovID with a Standard or Strong identity strength, and information to verify your identity, you can log in and apply for your director ID. The application process should take less than 5 minutes.

If you can’t get a myGovID with a Standard or Strong identity strength, the best way to apply for a director ID will depend on your situation.

Apply by phone

You can apply by phone if you have:

When you have the information you need to apply, contact ABRS.

Apply with a paper form

If you can’t apply online or over the phone, you can apply using a downloadable form – Application for a director identification number (NAT75329, PDF, 306KB). This is a slower process and you will also need to provide certified copies of your documents to verify your identity. If you have issues completing the form, you can find help on ABRS Accessibility page.

If you are already a registered director then you have 12 months to obtain this, however, we would suggest prioritizing to sort this as soon

as possible to ensure adherence to the new rules.

If you are looking to start in this role, you will have 28 days to obtain your Director ID from when the company is established.

When you plan with intention - and pair it with accountability - you’re not just hoping things will work out. You’re building a business that will.

.jpg)

Let’s face it; bookkeeping isn’t the most exciting part of running a business. However, it’s one of the most important! Keeping your financial records in check not only helps you stay on top of your business but moreover ensures you're meeting Australian Taxation Office (ATO) requirements without stress or penalties.